Feel free to use Raytheon Technical Services Corp as a reference. I’m amazed at what you’ve been able to accomplish for us. We are in a big budget crunch and our finance people were very pleased with what you’ve saved us. As you know, the State denied our exemptions on electric in the past. Based on our opinion from our finance department, they said we only use gas and water for heating and air conditioning, so we didn’t even consider qualifying for exemption on water and gas.

However you said the State erred and that finance wasn’t aware of the special circumstances in which the plant used gas and water. You told us we have a strong argument for exemptions on all 3 utilities, and that you would represent us in the appeal process. We had our doubts, but you’ve finally gotten the State to reverse their original position, and they approved all three utilities, the electric, gas and water – saving us $125,000/yr.

I personally want to thank you for your persistent and professional work. You told us we were entitled to and exemption even when the State denied the claims. We turned the issue over to you, and we didn’t have to spend time on it, and we wound up with great results. Thanks for making me look good!

Have any prospective client call me if they want because they couldn’t get a better advocate to go after all the savings that’s on the table.

- Michael Aronson

Raytheon Technical Services Company

317-306-4444

Brinly-Hardy Company worked with Mark Winski, On Your Mark, during 2004 to obtain exemption from sales taxes on our gas, electric and water utilities. We opted to use Mark’s services because of the knowledge of the process and value added service that saved us from expending internal resources to complete.

Mark’s efforts resulted in initial refunds of over $40,000 and annual savings in the range of $12,000 to $15,000 per year thereafter. Mark’s work with our company was completed in 2005, but he has worked with us recently to follow up on an ST-109 exemption resulting from the work he completed in 2005. This type of support and follow-up several years after the fact only solidify our feelings that Mark works with his customers to meet their needs and ensure they are happy with his work.

The experience working with Mark was positive. The process took very little of our time and resulted in significant savings for our company. We would recommend his services to other companies looking to have this type of work done.

- Carol Atkins

Brinly-Hardy Company

Supreme Corporation (www.supremecorp.com) is a nationwide truck body manufacturer with the production facilities located throughout the continental United States. Part of my responsibility includes the payables function, which includes the payment of the utility bill. I have long known about the predominant use tax exemption from the State but was unsuccessful (you have to dot all the i’s & cross all the t’s).

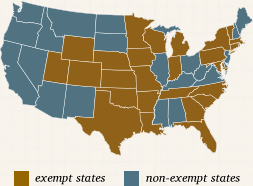

I came to know Mark Winski with On Your Mark, Inc as a result of a fax he sent to us, probably similar to your situation since you’re now reading this letter. We have contracted with Mark to gain the exemptions that we’re entitled to and have been very satisfied with the results of this relationship. For reasons too complicated to go into here (none of which I might add should be considered as a reflection of the quality of his work or efforts), it has been a long, drawn out process. Mark has stayed with us from the beginning, helping us to get beyond all of the hurdles placed before us by the State. In addition to our Indiana operation, Mark has gained this exemption for us in Pennsylvania & Texas and he is now working on Michigan, where we recently started a production facility.

Our annual savings are significant (approaching six figures). We would not have achieved these savings without On Your Mark, Inc. He understands the process & regulations & he will represent you to resolve any differences that you may have with the taxing authorities in this area. His expertise is not limited to the State of Indiana, he has extensive knowledge in this area for all of the states. I would encourage you to take advantage of the opportunity to utilize his services, I do not believe that you will be disappointed.

- Robert E. Ott

Supreme Industries Inc

bob.ott@supremecorp.com

We wanted to let you know that we appreciate the work you did for us. Like most companies it is our practice to save money and reduce costs wherever we can, but you made it so easy for us. It went exactly as you told us – that you would do all the work and stay with it until the tax came off the bill. Once we provided you with the copies of the bills, the next thing we knew was that the exemptions that you filed for gas and electric in both Indiana plants were approved – the tax was removed from the bill. This resulted in a $10,455/yr savings, and we didn’t have to do a thing.

We were skeptical about having you look at our Texas plant’s utility bills because some time ago, we had used another sales tax service like yours who got us partially exempt – and we thought it had already been handled. We were so glad you insisted in reviewing the Texas utility bills because you found that 3 meters were 72%, 80% and 100% exempt. The exemptions you got us for the 3 gas meters used in production areas, give us an additional savings of $6,425/yr.

I know you don’t like to brag but you made sure nothing was overlooked, and we are now confident we’ve maximized the savings – there’s no tax on any of our bills in the 3 plants. Thank you for your help, and the professional way in which you go about your business.

I’d be happy to recommend your services to anyone with sales tax on their bills who is looking to make sure they’ve obtained all the benefits from utility exemptions that the State(s) allow.

Feel free to have any prospective clients give me a call.

- Ruth Hoon

Arden Companies

rhoon@ardencompanies.com

248-368-6616

This is to confirm that ON Your Mark has represented Walgreens since 2005 to obtain savings from utility sales tax exemptions that is available to Walgreens. We have found that On Your Mark is experienced and knowledgeable in maximizing savings.

To date our utility bills have been reduced by $87,500/yr and On Your Mark estimates an additional $100-$150,000/yr in savings when the work has been completed in all states that have tax exemption. Since we are opening stores on a continual basis, we expect to retain On Your Mark to process future exemptions, and to assist us at exemption renewal time.

If On Your Mark had not brought this to our attention we would not have taken advantage of the savings. We probably could not have maximized the savings due to manpower and experience. Once our tax department has turned all of this work over, we have been very pleased with the savings and service.

What we like about On Your Mark is that:

- It takes very little of our time

- The savings are significant and prompt; we do not have to wait

- On Your Mark is easy to work with; does reliable, detailed work

- On Your Mark is an advocate on our behalf, and he represents us in any issues that arise with the utility company and/or the State.

- On Your Mark handles the whole exemption process from beginning to end, and leaves nothing undone.

If we had it to do all over again, we would gladly make the same decision to have this work done by On Your Mark.

- Brittany Bielecki

Walgreen’s Corporate Office

brittany.bielecki@walgreens.com

I am Jillian Kornac, Resource Manager for Dreyer Corporation, a wholly owned subsidiary of Nestle Corporation out of Lausanne, Switzerland. Dreyer’s is the largest manufacturer of ice cream and ice cream products in the US with 6 large manufacturing plants throughout the US.

Mark performed the engineering studies for us in Houston, Ft. Wayne, and Salt Lake City, and he provided us with copies for the utility company and our files.

I enjoyed working with Mark because he did what he said he would do, was good at follow-up with us and the utility companies, and he kept me well informed along the way. The best part is that it took none of my time, and protected me from an embarrassing position had we gotten socked with a big liability.

Feel free to contact me at any time to discuss the work.

- Jillian B. Kornac

Dreyer's Grand Ice Cream

JBKornac@dreyers.com

323-833-8612