- When is the best time to file the exemption application?

- What are On Your Mark’s fees?

- Do states require professionals file the exemption application and engineering study?

- What happens if the State denies the exemption application when in fact the manufacturer does qualify?

- Why is advocacy important?

- What is the attitude of the Dept. of Revenue on sales tax exemptions for utilities?

- Describe On Your Mark’s experience

- What is the advantage of a manufacturer using a professional utility sales tax exemption?

- When does the exemption expire?

- Can a regular sales tax exemption certificate be filed with the utility company?

- Will the utility company perform the engineering study?

- Why is sales tax on the utility bill?

When is the best time to file the exemption application?

As soon as you want to get the tax removed.

What are On Your Mark’s fees?

Contingent on savings. If there’s no savings, no fees paid to On Your Mark. On Your Mark’s fee is only charged to client after client obtains the exemption and refund (if any). No additional charge for On Your Mark representing its clients in the appeal process.

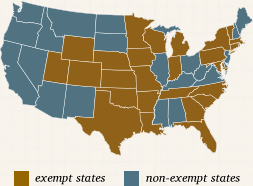

Do states require professionals file the exemption application and engineering study?

No except in Texas (see Texas). Any manufacturer can complete and file the utility study. Because the states require accurate studies and will deny studies with insufficient information, most states prefer the work be submitted by a professional.

What happens if the State denies the exemption application when in fact the manufacturer does qualify?

Each state has an appeal process in which the denial can be protested. On Your Mark represents their client in any appeal process at no extra charge to the client. On Your Mark is experienced in the appeal process, and has been very successful. We vigorously defend our client’s rights and provide detailed evidence and arguments as to why a client qualifies for the exemption.

Why is advocacy important?

There are many areas in the engineering study in which the State can and will argue that certain utility usage is not production and therefore does not qualify for exemption.

For example:

- Electric used for a lift truck that performs work outside the production process, e.g. loading, unloading trucks or warehouse storage; and also moving material during the production process.

- Heating and air conditioning provides comfort for employees when the utility usage also controls the environment which is necessary for production.

Both of these cases the utilities described qualify as production. In cases where the state takes an adversarial position, On Your Mark provides evidence and argues the case vigorously for production usage.

What is the attitude of the Dept. of Revenue on sales tax exemptions for utilities?

In some states the exemption regulations are interpreted very narrowly. In some cases, the State can deny an exemption when in fact the manufacturer actually qualifies. On Your Mark knows what qualifies and always takes an aggressive position to defend the manufacturer’s position for exemption.

Describe On Your Mark’s experience

On Your Mark is staffed with experienced CPA’s and engineers specialized in the field of utility studies. On Your Mark is one of the oldest professional services in the US, obtaining exemptions since 1975. On Your Mark has obtained exemptions for 3160 manufacturers and restaurants over the past 35 years. On Your Mark has been very successful in representing its manufacturing clients in the appeal process in order to defend the client’s qualification for exemption.

In the past 35 years, On Your Mark has had 85 applications denied, for which a protest was filed in every case. Eighty-four of these denied exemptions were subsequently overturned, and approved through the appeal process.

Our strengths lie in being very familiar and experienced with tax regulations, court cases, appeal procedures, and engineering methods to maximize savings. We have developed good working relationships with the Dept. of Revenue personnel in most states.

What is the advantage of a manufacturer using a professional utility sales tax exemption?

A professional can minimize the chance that an exemption application will be denied. A professional makes sure that the required documentation is accurate and filed. A professional will usually get the exemption approved sooner. On Your Mark typically gets everything filed in 30 days.

The manufacturer spends no time on:

1. Engineering study – no one has to learn the State’s requirements, no one has to do the study, no time spent in correcting errors on the study

2. Learning the process, and equipment classification

3. Answering Department of Revenue or utility co. questions

4. Follow up to expedite and process the exemption application

On Your Mark is the best advocate for clients in order to maximize the savings.

When does the exemption expire?

In most states, the exemption does not expire nor need to be renewed. However, there are situations which occur that the sales tax is put back on the bill, and/or a new utility study must be completed.

Expiration states: Texas – 5 yrs; Michigan – 4 yrs; Iowa – 3 yrs; PA – 5 yrs ; Vermont – 3 yrs. ; Wyoming – 3 yrs.; CT – 6 yrs

Can a regular sales tax exemption certificate be filed with the utility company?

In most states, the answer is no. Since a utility study is required in every state with an exemption, there typically is a special exemption certificate used for electric, gas, and water. The proper documentation and the detailed engineering study meeting Department of Revenue requirements usually accompanies the exemption certificate. Each state has a different procedure for filing the exemption and classifying production equipment versus non-production.

Will the utility company perform the engineering study?

Since the utility company has no stake in the exemption, they do not provide manpower to perform the study. It is up to the taxpayer to determine the annual usage of every piece of equipment that uses that particular utility, be it electricity, natural gas, or water. The study involves many interpretations of the tax law as to what equipment is production versus non-production, and the utility company is not prepared nor knowledgeable in tax classifications.

Why is sales tax on the utility bill?

Every utility company is required to charge sales tax unless the customer files a valid exemption certificate. The utility company typically does not promote, publicize, or assist in obtaining exemptions – it is just a pass through for the utility company. The exemption is not the responsibility of the utility company rather they are only a conduit to collect tax and remit to the state. It is the responsibility of the taxpayer to provide evidence and documentation of exemption before an account or meter is exempt.