How to save on utility cost:

Since all utility companies nationwide (with few exceptions) are required to charge sales tax to every customer, there is good value to obtaining a valid utility tax exemption. Each state has its own specific requirements and procedures to qualify for a tax exemption. When the exemption completed it is worth a 5-8% savings that is usually permanent.

When is the best time to file the exemption application? As soon as you want to get the tax removed.

Sales Tax Exemption:

Government offices and most not-for-profit entities qualify for the exemption without must effort. For a manufacturer to qualify, there is more to the exemption. A detailed utility study depicting how the utility from each meter is used is required. In addition, the annual consumption from each item or piece of equipment using that utility must be included.

To Qualify:

The utility study is the cornerstone of the requirements to qualify. When completed properly and an exemption certificate is provided to the utility company, sales tax is removed or reduced directly from the bill. In some states, a portion of the sales tax savings is to be reported on the use tax return. On Your Mark scope of work includes completing the utility study and all other required documentation. On Your Mark’s clients spend no time or effort once On Your Mark is authorized to proceed.

Predominate Usage Requirement:

Some states require that the utility study show that more than 50% of the utility meter’s usage is consumed for production purposes as opposed to non-production uses such as lighting, office, heating, air conditioning, etc. However in some cases, these general non-production uses just mentioned may actually be considered as production. On Your Mark makes sure to take advantage of all such special cases for the benefit of its clients, maximizing the value of the utility tax exemption.

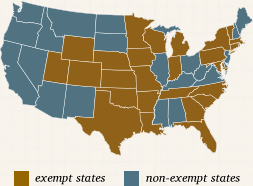

What is required in your state? Since each state has its own process and requirements for the exemption, click on your state for specific details.

When is the best time to file the exemption application? As soon as you want to get the tax removed.

What does a client get from On Your Mark?

- Maximum savings. A strong advocate to identify, qualify and obtain the maximum savings from the exemption.

- No time, money upfront or risk by a client to obtain the savings.

- Never have to spend time again. Once On Your Mark completes their work, the sales tax savings is maximized and doesn’t have to be revisited in the future.

On Your Mark Background and Experience:

On Your Mark has provided this specialized utility sales tax service for 38 years, having extensive experience in the 26 states with utility tax exemptions. A few of our clients are instantly recognizable.

- Walgreens engaged On Your Mark to represent them nationwide to obtain sales tax exemptions on the portion of electric consumed in their photo departments. Over 900 exemptions were obtained in all the states that were qualified.

- Nestles Corp. contracted with On Your Mark to complete the utility studies for their US production plants to perfect their exemptions that were in question by the utility company.

- Raytheon Corp., one of the largest defense contractors requested On Your Mark represent them in obtaining the sales tax exemptions for their 2 largest plants in Indiana after the state denied their exemptions. On Your Mark obtained the both gas and electric exemptions representing Raytheon through the appeal process and success in Tax Court.

- Boston Market and Krispy Kreme engaged On Your Mark to obtain their utility exemptions nationwide for gas and electric.

- McDonald’s (Indiana): Since restaurants qualify for the utility tax exemption in Indiana, On Your Mark has obtained exemptions for McDonald’s operators on gas, electric, and water.

On Your Mark’s Success for its Clients:

On Your Mark has filed 3160 exemption applications on behalf of its clients. All but 85 exemptions were approved upon submission. On Your Mark appealed all 85 denials, and represented all 85 clients at no additional charge. All but one denial was overturned and subsequently approved – either at the hearing level or in Tax Court. We lost one.

The Value of On Your Mark’s Advocacy for its Clients:

The reason we mention our experience is to give prospective clients an idea of the process and our success. When our evaluation of the utility study shows that our client’s meter(s) qualifies, we aggressively pursue the exemption. In cases where the State may not agree with our evaluation, we have the evidence, tools, tenacity, and ability to successfully defend and sustain the rights of our clients.

When is the best time to file the exemption application? As soon as you want to get the tax removed.

Contact Mark Winski to get started!