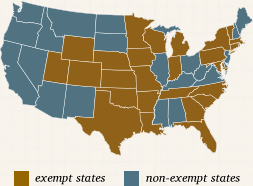

As a manufacturer, you are entitled to various tax exemptions that can save your business money. A Manufacturing Sales Tax Exemption on utilities is available in 26 states and should be taken advantage of.

Historically, many states have allowed manufacturing sales tax exemptions on electric, gas, and water used in production. This tax incentive was offered in order for states to compete for manufacturers to reside in their respective states.

Historically, many states have allowed manufacturing sales tax exemptions on electric, gas, and water used in production. This tax incentive was offered in order for states to compete for manufacturers to reside in their respective states.

However, these manufacturer tax incentives, put in place by state legislatures, are at continued risk due to state budget restraints. States are taking a close look at restricting or eliminating the sales tax exemptions on utilities used in production. Some states have passed regulations in 2010 and 2011 further limiting or eliminating the exemption; subsequently each of those states has taken further action to replace the exemptions almost to their original language. Since this exemption is on the radar of state legislatures, there is no question manufacturers should not delay in taking advantage of qualifying. The sooner a manufacturer qualifies for an utility tax exemption, the greater chance the manufacturer has of keeping this exemption indefinitely. To date there have been no conversations within the legislature that exemptions would be repealed once granted, which means that any changes would most likely grandfather existing exemptions.

See the examples below of recent changes made by certain states.

- Indiana. Effective 7/1/11, Indiana reduced the look back period for a refund of sales tax paid on exempt utility meters to 18 months which had historically been 3 yrs. plus the current year in which the claim was filed. The legislation has subsequently changed the look back period to 36 months effective 7/1/12. The exemption has not been effected.

- Colorado. Effective 1/1/10, Colorado eliminated the sales tax exemption on utilities. Due to the pressure from state manufacturing lobbies, the state legislature reinstated the exemption effective 7/1/12.

- Kansas. Effective 7/1/11, Kansas reduced the look back period to 12 months for a refund on sales tax on exempt utilities. Similar to Indiana and Colorado, lobbying efforts and outside manufacturing pressure subsequently reinstated the statute of limitation period for a sales tax refund to its original length to 36 months, effective 7/1/12.

In order to qualify for the exemption, a manufacturer must meet the state’s requirements for the exemption. Each state has different requirements and procedures to qualify. However, one requirement is universal – a utility study must be submitted with the application for exemption or the exemption certificate. In general the exemption is designed to grant sales tax relief for utilities used in production versus indirect uses such as office, heat and air conditioning, lighting, etc. The utility study is the document that provides evidence to the state as to how much consumption from any particular meter is used for direct production.

For all your Manufacturing Sales Tax Exemption questions please fill out our contact us form and we will respond immediately.